Medicare 8 minute Rule Billing: Also Known As Direct Time CPT Codes

Posted on November 30th, 2023 / Under Medical Billing / With No Comments

Underbilling is a serious issue in the healthcare industry, and one primary cause is the providers’ lack of knowledge regarding Medicare rules. One commonly understudied Medicare rule is the 8 minute rule.

At first glance, the Medicare 8 minute rule seems fairly straightforward; treatments are billed to Medicare in units, and treatment must last no less than 8 minutes for a unit to be billed to Medicare.

Unfortunately, oversight in this regard could lead to mistakes, resulting in problems like incorrect billing, underpayment, or delayed reimbursement.

As a provider, here is how to avoid mistakes when using the 8 minute rule units to bill Medicare.

Understanding the 8-minute Rule in Billing

As established earlier, to receive payment from Medicare for some CPT codes, a provider should provide direct treatment to a patient for a minimum of 8 minutes.

Any service, specifically outpatient therapy services like physical or occupational therapy, that lasts less than 8 minutes in duration, cannot be billed to Medicare. This rule also only applies to time-based CPT codes.

It’s also crucial to understand that only certain services fall under this rule, such as Medicare Part B services. It also applies to payers who follow Medicare billing guidelines; in addition, the 8-minute rule only applies when the service is performed in person.

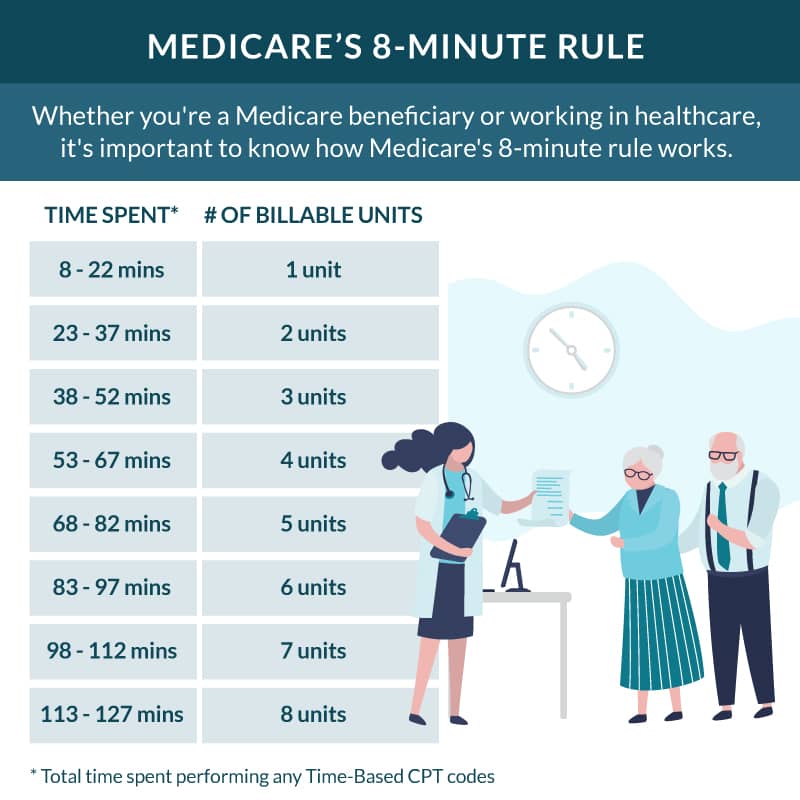

Services covered by the Medicare 8 minute rule are billed in 15 units.

For example, if a service lasts anywhere between 8 to 22 minutes, it would be billed in a single unit. But if the service takes more than 22 minutes, such as 37 minutes, Medicare will be billed 2 units for each 15-minute interval and so on. You can review the Medicare 8 minute rule chart for a clear understanding of billable units.

However, any services that last less than 8 minutes may not be separately billable. In case a patient is provided more than one service or procedure in a single minute, Medicare would review the combined minutes of each service. If the combined minutes pass the minimum threshold of 8 minutes, Medicare can be billed separately for each type of service.

The CMS 8 minute rule applies to outpatient service providers, including hospital outpatient departments, private physical therapy clinics, rehabilitation facilities, occupational therapy clinics, nursing facilities, and speech-language pathology centers.

Medicare rules, such as the AMA 8 minute rule, do not apply to non-medical insurance unless stated explicitly in their policies. That is because most private insurance companies don’t allow mixed remainders.

Mixed remainders are referred to as the leftover hours of a multiple-timed service that do not meet the minimum threshold. Mixed remainders from different services can be combined to meet the 8-minute threshold and be billed as units. Moreover, the 8-minute rule also applied to Medicaid services.

You can also refer to the 8 minute rule cheat sheet to understand the difference between billing for insurances that follow CMS guidelines and those that follow AMA guidelines.

Difference Between Time-Based CPT Codes and Service-Based CPT Codes

Service-based codes are generally untimed and billed as a single unit as they do not depend on the amount of time a service takes. Some common examples of service-based codes are E/M (Evaluation and Management) codes, procedures, and diagnostic tests. Service-based codes are reimbursed depending on the complexity of the service provided.

On the other hand, time-based codes are billed in 115 increments, depending on the amount of time spent on a service. There is also a set of rules that apply to make time-based codes billable. For example, the service provided should have been one-on-one for a time-based code to be reimbursed.

In some cases, time-based units and service-based units can be a part of the same treatment session, but they will still be billed separately.

Calculating Billable Units

Knowing how to calculate medical billing units is essential for claims scrubbing and submission. Here is how you can calculate billable units.

- Firstly, calculate the number of minutes spent on a service.

- Divide the total number with 15. This would give you the amount of billable units.

- Now, identify any leftover minutes. If there are multiple leftover minutes from different services, you will now have what is called a mixed remainder.

- If the mixed remainder is equal to or greater than half of the minimum threshold (which in this case would be 4 minutes), it can be rounded up to another billable unit.

Consider this example: if the total number of minutes you spent on a time-based service was 30, you can divide it by 15. This way, you will get two billable units.

Key Differences Between Rule of 8s and 8-minute Rule

Many people confuse the rule of 8s with the Medicare 8 minute rule when, in fact, the rule of 8s is the label used to describe the 8 minute rule in the CPT code manual. Typically, the rule of 8s is applied to non-medical insurance payers for Direct Time CPT Codes.

While the rule of 8s follows the same principles as the 8-minute rule, there is a bit of distinction. For instance, the rule of 8s requires practitioners to provide at least half of the service to bill for one unit.

8-minute Rule Mistakes to Avoid

It can be challenging to properly bill under the Medicare 8 minute rule for physical therapy.

There are often certain mistakes people make, like presuming they’ll be getting charged extra for services lasting longer than 8 minutes or believing that this rule applies to all types of services provided by their assigned physician.

Physicians should discuss the 8 minute rule with Medicare beneficiaries to alleviate their concerns and answer relevant queries.

On the provider end, to avoid any billing mistakes while using the 8 minute rule, you should,

- Accurately document the total time spent performing billable activities.

- Bill in correct increments. For instance, bill for three units if the total time spent on service is 52 minutes.

- Assign correct CPT codes to the services provided.

- Provide clear and concise documentation detailing the services provided to the patient and the patient’s response to the treatment.

- Train your healthcare staff on how to utilize the Medicare 8-minute rule properly.

FAQs

How many minutes are in a billing unit?

According to the 8-minute rule by Medicare, a billing unit typically equals 8 minutes of a physician’s time. So, if a physician performs a service that takes around 8 minutes, it will be billed as one unit.

8-minute rule importance in physical therapy?

The 8 minute rule guides physical therapy specialists on how to properly document their time during a patient encounter and perform accurate billing for reimbursement. Adhering to the 8 minute rule helps physical therapy clinics optimize revenue.

Read More...Medical Practice Management Software: Various Uses For Maximizing Healthcare Efficiency Including Billing Tasks

Posted on November 29th, 2023 / Under Medical Billing / With No Comments

People belonging to the healthcare industry, whether therapists, direct care practitioners, specialists, or chiropractors, all know that the realm of medical practice is extremely fast-paced.

Managing all operations from the front desk to the back office can be considerably challenging for healthcare organizations. But this is where a Medical Practice Management Software, also known as PMS, comes in.

The benefits a PMS brings to the table for a healthcare practice go beyond just organizing patient records, reporting, and appointment scheduling. In fact, it plays a much more pivotal role, streamlining some crucial operations, including billing tasks.

Let’s dive right in and learn the importance of cloud-based medical practice management software, its critical features, and its benefits.

Importance of PMS in Healthcare

Practice management involves both routine operational and financial tasks. Many large hospitals and healthcare organizations have professionals overlooking such tasks, but it’s often challenging for small and medium-sized healthcare practices to do the same.

So, instead of handling the administrative burden of keeping every operation organized on its own, small and medium-sized practices can invest in medical practice management software.

There are typically four main types of PMS, cloud-based medical practice management software, desktop-based PMS, client-server PMS, and on-premise PMS. To choose the right PMS for your practice, consider checking medical practice management software reviews.

Overall, a PMS can significantly contribute to the efficiency of a practice. Let’s break down the tasks a PMS can streamline for healthcare organizations.

- Keeping sensitive patient information protected against breaches.

- Automating appointment scheduling to reduce wait times.

- Recording and managing patient demographic information.

- Reducing the likelihood of errors in the medical billing process.

- Integration with payers to improve information exchange and streamline claims submission.

- Generating reports to facilitate audits.

Features of Medical Practice Management Software

Each PMS in the market comes with a distinct set of features, but let’s review some standard medical practice management software features you should look for.

1. Integration With Other Systems:

PMS can seamlessly integrate with other systems like EHR, EMR, and Telehealth functionalities. This type of integration improves the overall quality of patient care.

For instance, integration with an EHR (Electronic Health Records) system contributes to error reduction and provides easy access to patient information.

It also minimizes the need for manual data entry, allowing physicians to easily access and update patient information and make informed medical decisions.

Similarly, integration with Telehealth facilitates the continuum of care, allowing physicians to conduct virtual consultations and share electronic prescriptions with patients.

2. Streamlining Billing Processes:

Billing accuracy is fundamental for any medical practice, and it can be achieved with the help of PMS. The billing management feature allows you to make online payments and create and send invoices.

It also helps minimize the need for separate billing software by eliminating coding errors. This improves reimbursement rates and cuts down the administrative burden on the healthcare staff, allowing them to focus more on providing quality patient care.

3. Enhancing Patient Engagement With Patient Portal:

One practical feature of the medical practice management software is allowing patients to participate virtually in their healthcare journey.

Through patient portals, patients are able to access their test results, access medical records, and schedule appointments with their physicians. This increases patient satisfaction.

4. Resource Management:

The resource management feature allows practices to utilize the PMS to keep track of the inventory. Practices can also create and manage schedules for equipment maintenance and automate the process of reordering medical equipment.

5. Reporting:

Practice management tools allow you to generate reports on insurance claims, patient demographics, and much more. These reports allow practices to analyze financial and operational performance and make data-driven decisions.

Essential Benefits of Using PMS

• Reduced Administrative Burden:

With critical tasks like generating invoices, managing appointment schedules, bookkeeping, collecting patient demographics, and more just a single click away, a medical practice management system greatly reduces the administrative burden on the staff of a healthcare practice. This allows the providers and staff to avert their attention to the delivery of high-quality patient care.

• Minimizing Wait Time and No-Show Rates:

Automating appointment scheduling allows providers to organize the schedule and minimize any delays, reducing wait time during appointments. PMS that contain medical CRM functionalities allows practices to send appointment reminders to patients, minimizing no-show rates due to missed or forgotten appointments.

• Seamless Billing:

Medical practice management software eliminates the need for any paperwork for billing. Providers can keep track of all payments and invoices using PMS. This also expedites the claims submission process and reduces claim rejection rates.

• Data Centralization:

With financial, patient, billing, and insurance information accessible in a single software, billing specialists, healthcare providers, and the administrative staff can collaborate seamlessly. Data centralization ensures the personnel of a medical practice are on the same page.

• Effective Communication:

Not only does PMS improve communication between physicians and patients but also allows integration with systems present on the payers’ ends, streamlining the exchange of information between billers, coders, and payers.

• Improved Patient Care:

Improving patient care is the bottom line for any healthcare practice, and implementing medical practice management software is a gateway to improved patient care and satisfaction. PMS reduces errors in medication and diagnosis, fostering better clinical decisions and improving patient outcomes.

• Transparency:

With the accessibility of generating performance reports, practices are able to analyze them and identify areas that require improvement.

FAQs

What are the key features of Medical Practice Management Software?

All patient management software in the market are different in some aspects, but some key features of practice management software include billing, scheduling, coverage verification, business intelligence, and patient data management.

What is the difference between EHR EMR and Practice Management Software?

EHR and EMR systems are primarily designed to facilitate practices in managing patient health data. However, EHR systems offer a more comprehensive view of such data.

On the other hand, practice management software also streamlines the operational and financial aspects of a practice, focusing on processes including billing and scheduling.

Read More...Physician Fee Schedule Policy Changes: Lookup Medicare PFS Proposed Rule

Posted on November 28th, 2023 / Under Medical Billing / With No Comments

The Medicare physician fee schedule dictates how services rendered by healthcare providers are compensated under the Medicare program for their services.

Centers for Medicare and Medicaid regularly update the physician fee schedule to align with technological changes and concurrent transformations within the healthcare industry.

Some exciting transformations are awaiting the healthcare landscape in the upcoming year and at the forefront lies the 2024 Medicare physicians fee schedule proposed rule.

Similar to the CY 2023 physician fee schedule, the 2024 physician fee schedule proposed rule is aimed at fostering a more equitable healthcare system. Effective implementation of the proposed policy changes will elevate the level of patient care.

Let’s uncover the basics of PFS and what the physician fee schedule final rule 2023 addresses.

Understanding PFS Basics

The world of healthcare finance is filled with intricacies, and the physician fee schedule is one of its cornerstones that every provider must understand thoroughly.

Simply put, a physician fee schedule is defined as a list of fees assigned to different services and procedures healthcare professionals render to patients. These lists are used by insurance providers and Medicare to reimburse physicians and other healthcare providers.

Physicians provide services in various healthcare settings, including hospitals, physicians’ offices, hospices, outpatient dialysis facilities, and clinical laboratories. PFS ensures that the payment rates remain consistent across all healthcare settings.

On the other hand, some payers also use the MPFS (Medicare Physician Fee Schedule) as a reference for reimbursing doctors. The MPFS is an annual rule that specifically outlines and updates reimbursement rates for services doctors render to Medicare beneficiaries.

According to the medicare physician’s fee schedule, procedures are assigned relative value by factoring in relevant practice expenses, liability insurance, and the physician’s work. This value is then multiplied by a conversion factor to derive payment rates.

To account for any regional variations in the cost of operating a practice, further adjustment to the derived value can be made using GPCI (geographic practice code index).

For an accurate reflection of the costs associated with a physician’s work and the technical resources utilized to perform a procedure or service, the professional and technical components of a service can be segregated.

For instance, the professional component of a service indicates activities such as evaluation of a patient, diagnosis, etc, and this component is billed by the assigned physician.

On the other hand, the technical component of a service signifies the use of facilities and equipment to perform technical aspects of a service such as a laboratory test or imaging. Technical components are typically billed by suppliers such as dialysis facilities, radiology centers, and ambulatory surgical centers.

Role of PFS In Medical Billing

The physician fee schedule holds great significance in the world of medical and physician billing, influencing how procedures and services are translated into proper codes, billed by suppliers and practitioners, and reimbursed by payers.

PFS provides a standardized framework for medical services’ reimbursement, contributing to billing transparency. This transparency allows payers to assess the validity of billed charges and for practitioners to comprehend reimbursement rates across different healthcare settings and different types of services.

PFS Payment Rates

The physician fee schedule is typically updated annually, and specific payment rates in PFS can vary depending on various factors, including updates made by CMS, geographical location of practice, and the types of services rendered.

However, there is a standard formula used to determine payment for a service, which is:

Work RVU (relative value units) x Work GPCI (geographic price cost index) + PE (practice expense) RVU x PE GPCI + MP (malpractice) RVU x MP GPCI = Total RVU x CF (conversion factor) = Payment.

Providers can use the medicare physician fee schedule lookup tool to get further insights on billing, coding, and payment rates.

Medicare Physician Fee Schedule Proposed Rule 2024

Here is what you should know about the 2024 medicare physician fee schedule final rule.

- Compared to the conversion rate of $33.58 in the CMS physician fee schedule 2022 and $33.06 in the 2023 medicare physician fee schedule final rule, the final CY 2024 PFS conversion factor was reduced by 1.15% to $32.74.

- In the CY 2024 proposed physician fee schedule, the overall rates will be subject to a reduction of 1.25%.

- CMS has also finalized reimbursement for providers who train other caregivers to assist patients diagnosed with specific illnesses. Payments will be provided as a part of the patient’s individualized treatment plan.

- Effective January 1st, 2024, an additional payment for the new add=on HCPCS code G2211 will be introduced.

- CMS has also finalized the definition for the phrase “substantive portion” used specifically for split/shared E/M visits. The substantive portion now signifies a key element of medical decision-making and more than half of the total time the physician or non-physician practitioner spends performing the split/shared E/M visit.

- On a temporary basis, health and well-being coaching services are being added to the Medicare Telehealth Services list for CY 2024.

- The implementation of the Appropriate Use Criteria (AUC) program has been temporarily put on hold by CMS.

- The 2024 PFS final rule also implements notable changes to the Medicare Shared Savings Program (MSSP).

FAQs

What is the difference between FFS and PFS?

FFS (fee-for-service) is more of a traditional payment model where providers are reimbursed for each service they render. On the other hand, PFS is a component of FFS in which payment rates are based on relative values.

What are the definitions for facility and non-facility for the physician fee schedule?

Facility and non-facility both refer to different payment settings. For instance, a non-facility rate is used for services rendered in non-facility settings like a physician’s office, and facility rates are used for services rendered in hospitals and other healthcare facilities.

Read More...Patient Demographics Documentation Guidelines

Posted on November 27th, 2023 / Under Medical Billing / With No Comments

When a patient enters a healthcare facility to acquire treatment, one of the first things the staff does is collect the patient’s information. That information is called patient demographics.

Sounds straightforward enough, right? Only patient demographics have much more depth to it than just supporting physicians in providing high-quality care.

Patient demographics serve a multifaceted role, addressing several concerns, one of which is payment collection. Demographic data not only informs treatment plans but also ensures billing accuracy.

Lack of accuracy in patient demographic collection can lead to increased cost and duplicate testing, according to AHIMA medical coding and patient demographic standards.

To ensure a smoother medical billing process, let’s dive into what’s included in patient demographics and why it is important.

What Do Patient Demographics Include?

An accurate and complete patient demographic form typically includes all the information that’s required to streamline the medical billing process. Patient demographics can include but are not limited to the following:

- The full legal name of the patient.

- Date of birth.

- Gender of the patient.

- Address and contact information such as phone number and email address.

- Social security number for insurance and billing purposes.

- Insurance information such as policy number, insurance coverage, and name of provider.

- Guarantor information for patients who are minors.

- Emergency contact information.

- Ethnicity and race.

- Marital status.

- Language preference to facilitate effective communication between the patient and the provider.

- Employment status, which can be relevant to insurance information.

Some healthcare providers may consider medical histories such as family medical history, present medical condition, drug or other allergies, and surgical history as non-demographic data and include it only in the patient medical chart, while others may include it in the demographic sheet.

Collecting Patient Demographics Data

Patient demographics are collected during the registration process and are generally digital. Healthcare facilities use EHR systems to capture and store patient demographic data.

Patient demographic forms are also updated and secured through patient portals. The CDI medical process is further implemented by a clinical documentation improvement (CDI) specialist to ensure the accuracy of clinical data.

While this data can be collected in multiple ways, the patient demographic sheet has to meet specific standards, such as being HIPAA-friendly.

If healthcare entities are taking a verbal approach, they should avoid using jargon that could confuse the patients and impact data accuracy. Healthcare professionals should also assure patients that their demographic data will be kept confidential.

While many EHRs are already configured to collect medical documentation, some practices have untrained staff that may not know how to work the system properly, resulting in missing or incomplete patient information.

According to the CMS Medical Record Documentation Guidelines 2022, insufficient medical documentation can allow the reviewer to reject claims, concluding that the billed services were either not provided or were not medically necessary.

The key to a successful collection of patient demographic information is for physicians to train their staff on how to effectively use EHR systems. Having a standard collection process and using advanced software can streamline the process of collecting patient demographics.

Importance of Patient Demographics

Here is why patient demographics are important.

Streamlined Medical Billing Process

One thing that consistently serves as a factor for claim denials is inaccurate and missing patient data. Patient demographic information directly impacts medical billing as it includes some critical information, including whether to bill the primary or secondary insurance provider for the services rendered to the patient.

Without gathering patient demographics, the billing procedure can be significantly delayed. For instance, without collecting such data, it can be difficult to confirm whether a patient without health coverage is eligible to be covered under the charity care program.

Cultural Competence

Patient demographics data such as race, gender, and age can assist you in creating individualized treatment plans for specific patient populations.

It’s essential to improve the cultural competence of your healthcare staff to make your practice an inclusive place where patients from all backgrounds can receive exceptional care.

An in-depth understanding of your patient’s history and cultural background will allow you to provide more personalized treatment to your patients.

Improving Patient Care

Assessing the details of the patient demographics can help you improve patient care by determining risk factors and prescribing effective treatment. Knowing the patient’s medical history will allow physicians to tailor treatment plans to their specific conditions, improving the level of care provided.

Gateway to Effective Patient Communications

One of the benefits of patient demographics is seamless communication between patients and providers. Many healthcare practices offer online portals to help patients update demographic information, such as their contact information, which may change over time.

This leads to a reduction in missed or canceled doctor’s appointments as patients can be reminded effectively. Doctors can also interact with patients better, ensuring they stick to their treatment plans.

FAQs

What are some things to keep in mind for patient demographics?

One thing you should keep in mind when managing patient demographics is that accuracy is paramount. Ensure that you collect all personal details precisely and address diversity and cultural sensitivity in your practice. Safeguard patient privacy and ensure regular updates on medical records to reflect any changes in treatment.

Where does HIPAA factor in?

HIPAA (Health Insurance Portability and Accountability Act) ensures the security and confidentiality of patient information, emphasizing the privacy rights of patients. All healthcare practices are required to comply with HIPAA standards to safeguard against unauthorized access to sensitive patient information.

Read More...

Recent Posts

-

False Claims Act Impact On Medical Billing and Coding

Initially, the False Claims Act in healthcare was enacted during the Civil wall to impose liability on individuals and organi...

Read More... -

Role of Encounter Forms in Provider Records and Billing

On average, a doctor wo...

Read More... -

Free Standing Emergency Rooms Billing Services And Your Need To Outsource

Freestanding ER may be a new trend in the healthcare industry, but they have been around for ages. The purpose of freestandin...

Read More... -

Physician Credentialing Importance In Healthcare Improvement

According to a recent survey, Read More...

-

Medicare 8 minute Rule Billing: Also Known As Direct Time CPT Codes

Underbilling is a serious issue in the healthcare industry, and one primary cause is the providers’ lack of knowledge regar...

Read More...